Page 28 - Atlas_2019_rus

P. 28

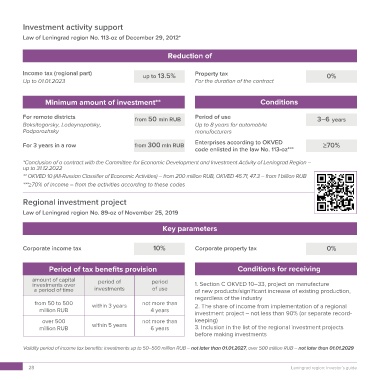

Investment activity support

Law of Leningrad region No. 113-оz of December 29, 2012*

Reduction of

Income tax (regional part) up to 13.5% Property tax 0%

Up to 01.01.2023 For the duration of the contract

Minimum amount of investment** Conditions

For remote districts from 50 mln RUB Period of use 3–6 years

Boksitogorsky, Lodeynopolsky, Up to 8 years for automobile

Podporozhsky manufacturers

Enterprises according to OKVED

Enterprises according to OKVED

For 3 years in a row from 300 mln RUB ≥70%

code enlisted in the law No. 113-oz***

code enlisted in the law No. 113-oz***

*Conclusion of a contract with the Committee for Economic Development and Investment Activity of Leningrad Region –

up to 31.12.2022

** OKVED 10 (All-Russian Classifier of Economic Activities) – from 200 million RUB, OKVED 46.71, 47.3 – from 1 billion RUB

***≥70% of income – from the activities according to these codes

Regional investment project

Law of Leningrad region No. 89-oz of November 25, 2019

Key parameters

Corporate income tax 10% Corporate property tax 0%

Period of tax benefits provision Conditions for receiving

amount of capital period of period

investments over 1. Section C OKVED 10–33, project on manufacture

a period of time investments of use of new products/significant increase of existing production,

regardless of the industry

from 50 to 500 within 3 years not more than 2. The share of income from implementation of a regional

million RUB 4 years investment project – not less than 90% (or separate record-

over 500 not more than keeping)

million RUB within 5 years 6 years 3. Inclusion in the list of the regional investment projects

before making investments

Validity period of income tax benefits: investments up to 50–500 million RUB – not later than 01.01.2027, over 500 million RUB – not later than 01.01.2029

28 Leningrad region: Investor’s guide