Page 31 - Atlas_2019_rus

P. 31

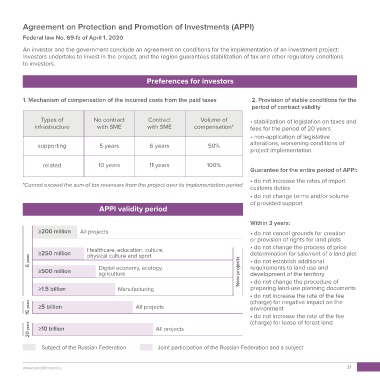

Agreement on Protection and Promotion of Investments (APPI)

Federal law No. 69-fz of April 1, 2020

An investor and the government conclude an agreement on conditions for the implementation of an investment project:

investors undertake to invest in the project, and the region guarantees stabilization of tax and other regulatory conditions

to investors.

Preferences for investors

1. Mechanism of compensation of the incurred costs from the paid taxes 2. Provision of stable conditions for the

period of contract validity

Types of No contract Contract Volume of • stabilization of legislation on taxes and

infrastructure with SME with SME compensation* fees for the period of 20 years

• non-application of legislative

supporting 5 years 6 years 50% alterations, worsening conditions of

project implementation

related 10 years 11 years 100%

Guarantee for the entire period of APPI:

• do not increase the rates of import

*Cannot exceed the sum of tax revenues from the project over its implementation period customs duties

• do not change terms and/or volume

of provided support

APPI validity period

Within 3 years:

≥200 million All projects • do not cancel grounds for creation

or provision of rights for land plots

Healthcare, education, culture, • do not change the process of price

≥250 million physical culture and sport determination for sale/rent of a land plot

6 years • do not establish additional

≥500 million Digital economy, ecology, New projects requirements to land use and

development of the territory

agriculture

preparing land-use planning documents

≥1.5 billion Manufacturing • do not change the procedure of

• do not increase the rate of the fee

(charge) for negative impact on the

15 years ≥5 billion All projects environment

• do not increase the rate of the fee

20 years ≥10 billion All projects (charge) for lease of forest land

Subject of the Russian Federation Joint participation of the Russian Federation and a subject

www.lenoblinvest.ru 31