Page 29 - Atlas_2019_rus

P. 29

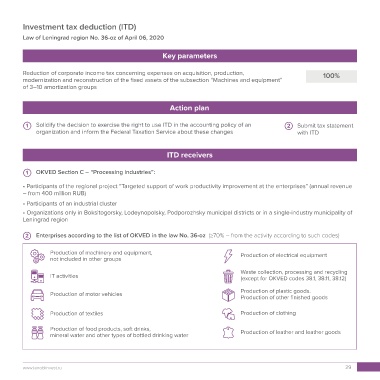

Investment tax deduction (ITD)

Law of Leningrad region No. 36-oz of April 06, 2020

Key parameters

Reduction of corporate income tax concerning expenses on acquisition, production, 100%

modernization and reconstruction of the fixed assets of the subsection “Machines and equipment”

of 3–10 amortization groups

Action plan

1 Solidify the decision to exercise the right to use ITD in the accounting policy of an 2 Submit tax statement

organization and inform the Federal Taxation Service about these changes with ITD

ITD receivers

1 OKVED Section C – “Processing industries”:

• Participants of the regional project “Targeted support of work productivity improvement at the enterprises” (annual revenue

– from 400 million RUB)

• Participants of an industrial cluster

• Organizations only in Boksitogorsky, Lodeynopolsky, Podporozhsky municipal districts or in a single-industry municipality of

Leningrad region

2 Enterprises according to the list of OKVED in the law No. 36-oz (≥70% – from the activity according to such codes)

Production of machinery and equipment, Production of electrical equipment

not included in other groups

Waste collection, processing and recycling

IT activities (except for OKVED codes 38.1, 38.11, 38.12)

Production of motor vehicles Production of plastic goods.

Production of other finished goods

Production of textiles Production of clothing

Production of food products, soft drinks, Production of leather and leather goods

mineral water and other types of bottled drinking water

www.lenoblinvest.ru 29