- about region

- For investors

- Measures of supportIndustry Development Centre of Leningrad RegionFund for Support of Entrepreneurship and Industry of Leningrad RegionAll Russia Public Organization Business RussiaUnion of Industrialists and Entrepreneurs of Leningrad RegionLeningrad Region Chamber of Commerce and IndustryBusiness Ombudsman of Leningrad Region

- Investment sites

- Our team

- FORUM BRIEF24

- Contacts

- about region

- For investors

- Measures of support

- Investment sites

- Our team

- FORUM BRIEF24

- Contacts

- RUENDEZH

- Инвесткарта

(ИРИС) - Личный

кабинет - +7 (812) 644 01 23aerlo@lenoblinvest.ru

- Назад

- Strategy 2030

- Region in figures

- Advantages of Leningrad region

- Territorial division

- Leningrad region for living

- Tourism potential of Leningrad region

- Presentation

- Назад

- Investment Niche

- Investment projects

- Become an investor

- Public-private partnership

- E-visa for foreign citizens

- Launch of projects

- Useful links

- Presentations

- Назад

- Economic Development Agency of Leningrad Region

- Council on Improvement of Investment Climate

- Committee for Economic Development and Investment Activity

- Events

- Назад

- Industry of Leningrad region

- Petrochemical industry

- Food industry

- Wood processing industry

- Automotive industry

- Building materials industry

- Назад

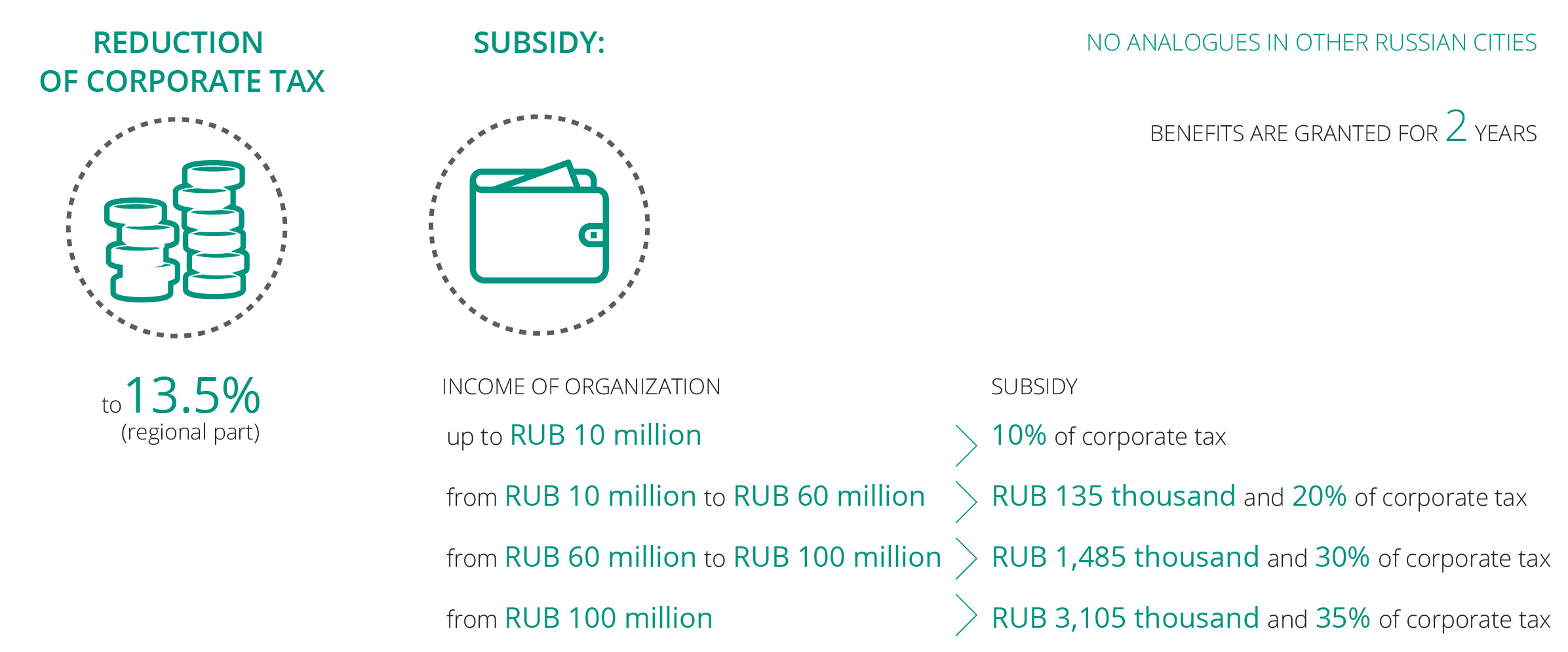

- Benefits for investors

- Benefits for industrial parks

- Benefits for traders

- Lease of land plots without bidding procedures

- Назад

- Industry Development Centre of Leningrad Region

- Fund for Support of Entrepreneurship and Industry of Leningrad Region

- All Russia Public Organization Business Russia

- Union of Industrialists and Entrepreneurs of Leningrad Region

- Leningrad Region Chamber of Commerce and Industry

- Business Ombudsman of Leningrad Region